As we are in to the 2020 US tax filing season, it is important to note the various annual adjustments the IRS makes annually to take in to account inflation. Below is a snapshot of the various tax rates, deductions, foreign earned income exclusion (FEIE) available to US expats with filing of their 2020 US tax returns.

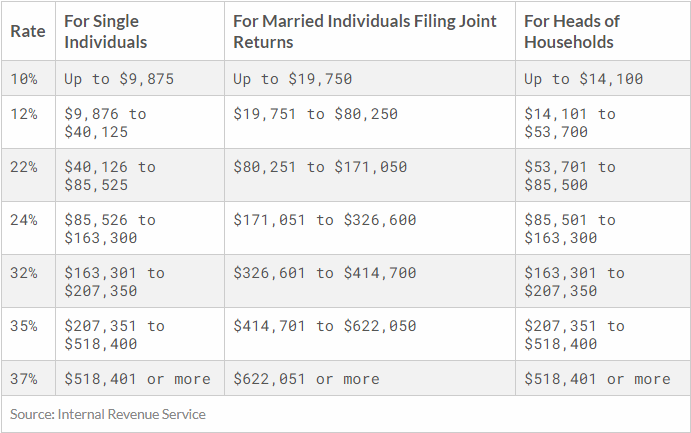

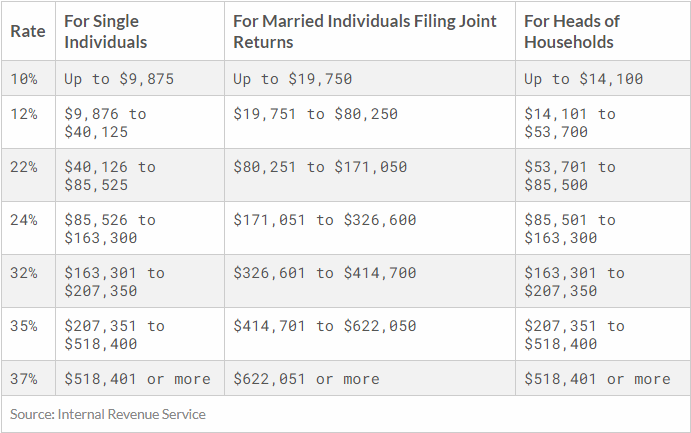

2020 INCOME TAX RATES

2020 STANDARD DEDUCTION

The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,400 in for 2020, up $200, and for heads of households, the standard deduction will be $18,650 for tax year 2020, up $300.

2020 Personal Exemption

The personal exemption for tax year 2020 remains at 0, as it was for 2019, this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

FOREIGN EARNED INCOME EXCLUSION THRESHOLD

Each year the IRS adjusts the maximum amount of FEIE to account for inflation. The FEIE amount for 2020 has increased to $107,600, which means that the first $107,600 of your foreign earned income can be excluded from taxation if you meet certain requirements as an expat. FEIE can be claimed by filing Form 2555 with your personal tax return.

2020 Annual Exclusion for Gifts

The annual exclusion for gifts is $15,000 for calendar year 2020, as it was for calendar year 2019. This means for any gifts made which are below this amount in the calendar year, these are exempt from reporting.

Tax Filing Assistance

For US expats requiring assistance with filing of 2020 US tax return or any of the prior year tax returns, contact us at https://www.expatglobaltax.com/, and we will immediately connect you with one of our Tax Specialist.

Our client satisfaction is what counts most. And for us to gather transparent, unedited, or not altered reviews, we have partnered with the trusted online review community, Trustpilot, to collect independent and verified reviews. Our objective is to provide you the opportunity to read what clients are saying about us.

If you are require additional details or have any questions, please visit https://www.expatglobaltax.com/ for more information.